The Wealth Glitch: Cracking the Money Code

Have you ever wondered why some people seem to have the wealth glitch cracking the money code figured out while others struggle paycheck to paycheck? It’s not just luck or being born rich – there’s actually a system behind it. This wealth-building secret has been hiding in plain sight, and once you understand it, your entire relationship with money changes forever.

The wealth glitch isn’t about get-rich-quick schemes or lottery tickets. It’s about understanding how money systems work, how wealth creation really happens, and why most people never learn these crucial financial strategies. When you crack this code, you start seeing opportunities everywhere that others completely miss.

Think of it like learning a new language. At first, everything sounds like gibberish. But once you understand the basics, you start picking up patterns and meanings. The same thing happens with money – there’s a language and system that wealthy people understand intuitively.

After spending years studying successful investors and entrepreneurs, I’ve discovered that wealth building follows predictable patterns. These aren’t complicated mathematical formulas or insider secrets – they’re simple principles that anyone can learn and apply starting today.

The beauty of understanding this wealth glitch is that it works regardless of your current financial situation. Whether you’re starting with nothing or already have some savings, these principles can accelerate your journey to financial freedom.

The Psychology Behind Money and Wealth Building

Your relationship with money starts in your mind, and this is where most people get stuck without realizing it. The wealth glitch cracking the money code begins with understanding that your thoughts about money directly impact your ability to build wealth.

Many people have been programmed from childhood to believe that money is scarce, that rich people are greedy, or that they don’t deserve financial success. These limiting beliefs create invisible barriers that sabotage every attempt at building wealth.

I used to think that wanting money made me selfish. This belief kept me from pursuing better opportunities and asking for raises I deserved. Once I realized that money is simply a tool that amplifies who you already are, everything changed.

Wealthy people think differently about money. They see it as a resource that can solve problems, create opportunities, and help others. They understand that money flows toward value creation, not away from it.

The first step in cracking the money code is examining your own beliefs about wealth. Do you believe you deserve financial success? Do you see money as good or evil? These core beliefs shape every financial decision you make.

Common Money Mistakes That Keep People Poor

One of the biggest mistakes people make is focusing on saving money instead of earning more money. While budgeting and cutting expenses have their place, wealthy people focus primarily on increasing their income streams.

Another major error is buying things that lose value instead of investing in assets that appreciate over time. Most people spend their extra money on cars, clothes, and gadgets that become worthless, while wealthy individuals buy stocks, real estate, and businesses.

Emotional spending destroys wealth faster than almost anything else. When people shop to feel better, celebrate, or cope with stress, they’re essentially trading their future financial freedom for temporary emotional relief.

Many people also make the mistake of keeping all their money in savings accounts that barely beat inflation. While emergency funds are important, leaving large amounts in low-interest accounts is like watching your purchasing power slowly evaporate.

The biggest mistake of all might be not starting early enough. Time is the most powerful factor in wealth building, and every year you delay costs you exponentially more in potential returns.

Asset Building Strategies That Actually Work

Real wealth comes from owning assets that generate income while you sleep. The wealth glitch cracking the money code involves understanding the difference between assets and liabilities, then systematically acquiring more assets.

Stocks and index funds are one of the most accessible ways to start building wealth. You can begin with just a few dollars and gradually increase your investments over time. The key is consistency and letting compound interest work its magic.

Real estate has created more millionaires than probably any other asset class. You don’t need huge amounts of cash to get started – many investors use other people’s money through mortgages to control valuable properties.

Starting a business or side hustle creates unlimited income potential. Unlike a job where your earnings are capped, businesses can scale infinitely if you build the right systems and processes.

Investing in yourself through education, skills, and network building often provides the highest returns of all. Every new skill you learn or valuable connection you make can multiply your earning potential exponentially.

The secret is to start somewhere and gradually diversify your asset base. Don’t wait until you have “enough” money – wealthy people start building assets with whatever they have and reinvest their profits to accelerate growth.

Passive Income Streams and Financial Freedom

Passive income is money that flows to you regularly without requiring active work on your part. This is perhaps the most important concept in the wealth glitch cracking the money code, because passive income is what ultimately sets you free from trading time for money.

Dividend-paying stocks provide regular income payments just for owning shares in profitable companies. Many reliable companies have been paying dividends for decades, providing shareholders with steady income streams.

Rental properties generate monthly cash flow from tenants while the property hopefully appreciates in value over time. This creates both passive income and long-term wealth building in one investment.

Creating digital products like online courses, ebooks, or software allows you to earn money from the same work indefinitely. Once created, these products can sell automatically without additional effort from you.

Royalties from creative works like books, music, or patents can provide income for years or even decades. Many successful creators build substantial passive income streams from work they completed years ago.

The goal is to build enough passive income to cover your living expenses. Once your passive income exceeds your monthly costs, you’ve achieved financial independence and can choose how to spend your time.

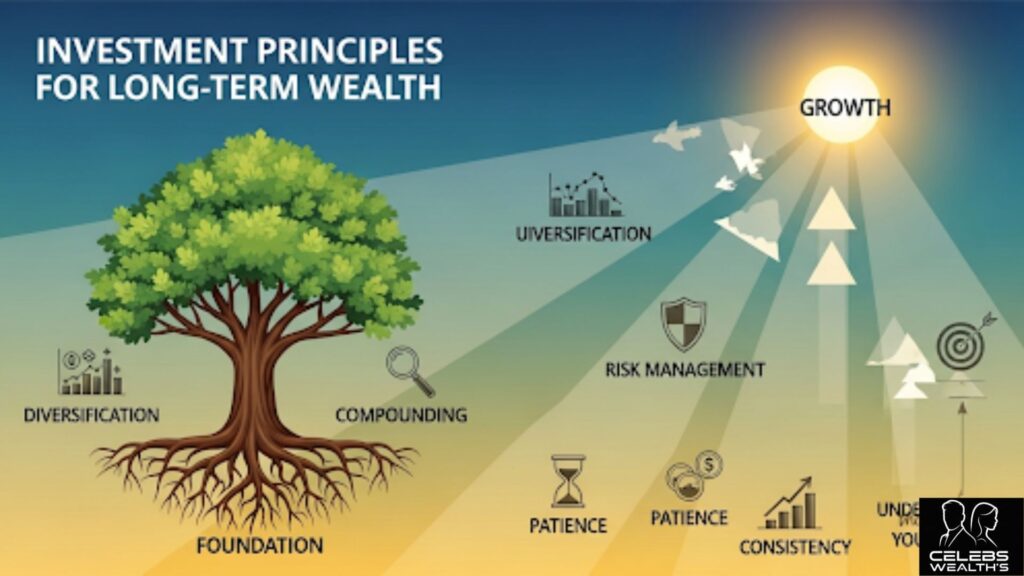

Investment Principles for Long-Term Wealth

Successful investing isn’t about picking hot stocks or timing the market perfectly. The wealth glitch cracking the money code reveals that consistent, boring investing strategies typically outperform flashy get-rich-quick approaches.

Diversification protects your wealth by spreading risk across different investments. Instead of putting all your money in one stock or sector, smart investors spread their investments across various asset classes and geographic regions.

Dollar-cost averaging involves investing the same amount regularly regardless of market conditions. This strategy removes emotion from investing and often results in better long-term returns than trying to time market highs and lows.

Starting early gives you a massive advantage due to compound interest. Even small amounts invested consistently over long periods can grow into substantial wealth thanks to the power of time and compounding returns.

Keeping costs low maximizes your returns over time. High fees and expenses can eat away thousands or even millions of dollars in potential gains over a lifetime of investing.

Staying invested during market downturns is crucial for long-term success. History shows that markets eventually recover from crashes, and those who stay invested typically come out ahead of those who panic and sell.

Creating Multiple Income Streams

Relying on a single source of income is risky in today’s economy. The wealth glitch cracking the money code involves creating multiple streams of income that protect you from economic uncertainty while accelerating wealth building.

Your primary job provides stability and cash flow to fund your other wealth-building activities. Focus on increasing your earning potential through skill development, networking, and strategic career moves.

Side businesses can start small and grow into significant income sources. Many successful entrepreneurs began their businesses as side hustles while maintaining their day jobs for security.

Investment income from stocks, bonds, and real estate provides returns that aren’t directly tied to your time or effort. This income can grow substantially over time through reinvestment and compound growth.

Freelancing or consulting in your area of expertise creates additional income using skills you already possess. This can be particularly lucrative if you have specialized knowledge or experience.

Digital income streams like affiliate marketing, online courses, or YouTube channels can scale to significant levels with the right approach and persistence. The internet has made it possible for individuals to reach global audiences and monetize their knowledge.

The Mindset Shift from Consumer to Investor

Most people are trained to be consumers – to buy things that make them feel good in the moment but don’t improve their financial situation. Understanding the wealth glitch cracking the money code requires shifting from a consumer mindset to an investor mindset.

Investors think about opportunity cost before making purchases. Instead of asking “Can I afford this?”, they ask “What else could I do with this money that might benefit me more in the long run?”

When wealthy people buy something, they often consider whether it’s an investment or an expense. Will this purchase help them make more money, save time, or improve their skills? If not, they often choose to invest the money instead.

Delayed gratification becomes easier when you understand compound growth. Spending $100 on clothes gives you temporary pleasure, but investing that $100 could be worth hundreds or thousands of dollars in the future.

Wealthy individuals focus on building net worth rather than looking wealthy. They’d rather drive an older car and invest the difference than make car payments on a luxury vehicle that depreciates rapidly.

This mindset shift doesn’t mean never enjoying life or spending money on things you value. It means being intentional about your choices and understanding the long-term consequences of your financial decisions.

Debt Management and Wealth Acceleration

Debt can be either a wealth destroyer or a wealth accelerator, depending on how you use it. Understanding the wealth glitch cracking the money code includes knowing when debt helps you build wealth and when it holds you back.

High-interest consumer debt like credit cards destroys wealth by charging you more in interest than you can typically earn through investments. Eliminating this debt should be a top priority for anyone serious about building wealth.

Good debt, like mortgages on rental properties or business loans, can help you acquire assets that generate income or appreciate in value. The key is ensuring the asset produces enough income to cover the debt payments plus provide additional profit.

Student loans can be considered good debt if the education increases your earning potential enough to justify the cost. However, borrowing excessively for degrees that don’t lead to higher-paying careers can be wealth-destroying.

Refinancing and consolidating debts at lower interest rates frees up more money for wealth building. Even small reductions in interest rates can save thousands of dollars over the life of a loan.

Using the debt avalanche or debt snowball methods helps you systematically eliminate debt while maintaining motivation. Once debt payments are eliminated, that money can be redirected toward investments and wealth building.

Building Generational Wealth

True wealth building extends beyond your own lifetime to benefit future generations. The wealth glitch cracking the money code includes strategies for creating wealth that lasts for decades or even centuries.

Education and financial literacy are among the most valuable gifts you can pass to your children. Teaching them about money management, investing, and entrepreneurship gives them tools that will serve them throughout their lives.

Estate planning ensures your wealth transfers efficiently to your heirs while minimizing taxes and legal complications. Proper planning can preserve significantly more wealth for future generations.

Family businesses and investment strategies can provide ongoing income and wealth building opportunities for multiple generations. Many of the world’s wealthiest families have built their fortunes through businesses and investments passed down over time.

Trust structures and other legal entities can protect wealth from taxes, creditors, and poor financial decisions by heirs. These tools require professional guidance but can preserve wealth for many generations.

Creating systems and processes that don’t depend on your personal involvement allows wealth to continue growing even after you’re gone. This might include investment accounts with professional management or businesses run by capable teams.

Technology and Modern Wealth Building

Modern technology has democratized wealth building in ways that weren’t possible for previous generations. The wealth glitch cracking the money code now includes digital tools and opportunities that can accelerate your journey to financial freedom.

Robo-advisors make professional investment management accessible to people with small account balances. These automated platforms can create diversified portfolios and rebalance them regularly for minimal fees.

Micro-investing apps allow you to invest spare change from purchases or small amounts regularly. While the amounts seem tiny, they can add up to substantial sums over time through consistent investing and compound growth.

Cryptocurrency and digital assets represent new asset classes that didn’t exist a generation ago. While volatile and risky, some digital assets have generated extraordinary returns for early adopters who understood their potential.

Online business opportunities continue to expand as internet adoption grows globally. E-commerce, digital services, and content creation can generate income streams that scale far beyond traditional local businesses.

Financial education resources are more accessible than ever through online courses, podcasts, blogs, and YouTube channels. You can learn from some of the world’s most successful investors and entrepreneurs for free or very low cost.

Real Estate as a Wealth Building Tool

Real estate has been a reliable wealth building tool for generations, and understanding how to use it effectively is crucial for cracking the money code. Property values tend to appreciate over time while providing rental income, creating both cash flow and long-term growth.

House hacking allows you to get started in real estate with minimal down payment by living in a multi-unit property and renting out the other units. This strategy can eliminate your housing costs while building equity and cash flow.

Real Estate Investment Trusts (REITs) provide exposure to real estate markets without the hassles of direct property ownership. You can invest in REITs through regular brokerage accounts and receive dividend income from professional real estate management.

Flipping houses can generate quick profits but requires significant expertise, time, and capital. While popular on television, successful flipping requires deep knowledge of construction, local markets, and project management.

Commercial real estate often provides higher returns than residential properties but requires larger initial investments and more sophisticated analysis. Many wealthy individuals eventually move into commercial properties as their knowledge and capital grow.

Real estate offers tax advantages like depreciation deductions, 1031 exchanges, and various write-offs that can significantly improve your after-tax returns compared to other investments.

The Role of Continuous Learning

Successful wealth building requires continuous learning and adaptation as markets, technologies, and opportunities change. The wealth glitch cracking the money code includes staying informed and expanding your knowledge throughout your wealth-building journey.

Reading books written by successful investors and entrepreneurs provides insights into proven strategies and common pitfalls to avoid. Many of the world’s wealthiest individuals are voracious readers who constantly seek new knowledge.

Attending seminars, workshops, and conferences connects you with like-minded individuals while exposing you to new ideas and opportunities. The networking opportunities alone can be worth the investment in education.

Following successful investors and thought leaders through books, podcasts, and social media keeps you informed about current market conditions and emerging opportunities.

Learning new skills increases your earning potential and opens doors to additional income streams. In today’s rapidly changing economy, adaptability and continuous skill development are more important than ever.

Joining investment clubs or mastermind groups provides accountability and support from others on similar journeys. Learning from peers who face similar challenges can accelerate your progress and help you avoid common mistakes.

Building Your Wealth Building Team

No one builds significant wealth completely alone. Understanding the wealth glitch cracking the money code includes assembling a team of professionals who can provide expertise, guidance, and support throughout your wealth-building journey.

A good accountant helps optimize your tax situation and ensures you’re taking advantage of all available deductions and strategies. Tax planning can save thousands of dollars annually that can be redirected toward investments.

Financial advisors provide investment guidance and help you stay disciplined during market volatility. While you can invest on your own, professional guidance can be valuable, especially for complex situations or large portfolios.

Real estate agents and property managers are essential if you’re building wealth through real estate investments. Experienced professionals can help you find good deals and manage properties efficiently.

Estate planning attorneys help protect your wealth and ensure it transfers according to your wishes. Proper estate planning can save your heirs substantial amounts in taxes and legal fees.

Insurance agents help protect your wealth from unexpected events that could derail your financial progress. Adequate insurance coverage protects your assets and income-generating ability from various risks.

Conclusion

The wealth glitch cracking the money code isn’t really a glitch at all – it’s a systematic approach to building wealth that successful people have used for generations. The principles are simple but not always easy to implement, requiring discipline, patience, and continuous learning. By understanding that wealth building is primarily about acquiring assets, creating multiple income streams, and making strategic financial decisions over time, anyone can begin their journey toward financial freedom.

The most important step is starting where you are with what you have, rather than waiting for perfect conditions that may never come. Whether you begin with $10 or $10,000, the principles remain the same: spend less than you earn, invest the difference in appreciating assets, and continuously educate yourself about money and investing. The wealth glitch isn’t about finding shortcuts – it’s about understanding the proven path that leads to lasting financial success and having the commitment to walk that path consistently over time.

Frequently Asked Questions

A: The biggest mistake is not starting at all due to perfectionism or fear. Many people wait for the “perfect” time or amount of money to begin, but consistent small actions over time typically outperform waiting for ideal conditions.

A: Generally, pay off high-interest debt (like credit cards) first, but you can start investing small amounts while paying off lower-interest debt like mortgages or student loans, especially if your employer offers matching contributions.

A: It’s never too late to start building wealth. While starting earlier provides advantages, people in their 40s, 50s, and beyond can still build substantial wealth by focusing on higher-return investments and maximizing their earning potential.

A: You can start building wealth with any amount, even $10-20. The key is beginning immediately and consistently investing whatever you can afford while gradually increasing your contributions over time.

A: It’s not a literal glitch but rather understanding the systematic principles that wealthy people use to build and maintain wealth, including asset accumulation, multiple income streams, and strategic financial decision-making.